WHAT IS AN ONLINE FINANCE DEGREE?

Online finance degree programs study how to create and manage wealth. They will often cover a wide array of topics and methods. Some of these include basic topics like how to invest and assess financial markets. Others may draw from business. Students may thus gain a well rounded grasp of accounting, economics and banking.

With modern tech comes new and exciting ways to think about financial matters. If you have an interest in how to manage money or advise others, a finance degree may be useful. It can help you learn the tools and skills you will need to enter and excel in the field of finance.

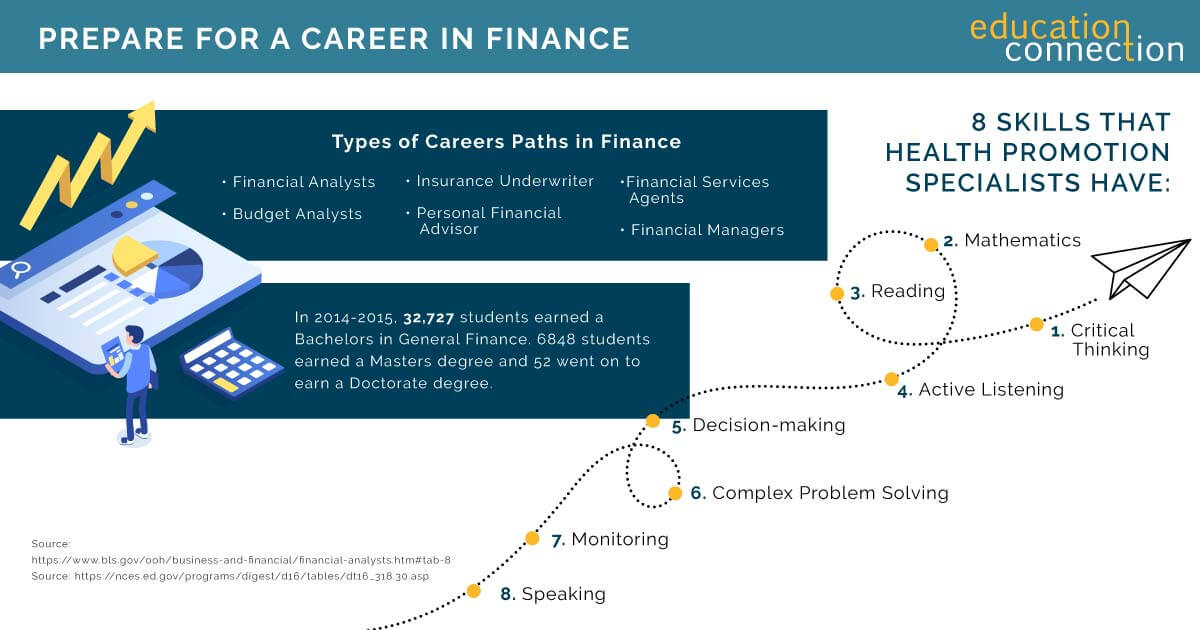

Depending on what you major in, you might pursue a career as a financial analyst in a large firm. This would involve how to look at the bottom line and how to predict profits. To give you an idea, those who pursue a career as financial analysts might earn an annual salary of $84,000.

Other paths may take you into fast paced careers where you might manage finances. Or into investment banking and private wealth firms. There are also careers in asset management, investments and equity research.

There are many ways to study things that matter to you and your goals. If you are ready to invest in your education, finance skills are in demand, so it’s a great time to start.

TYPES OF ONLINE FINANCE DEGREE PROGRAMS

Bachelor of Science in Finance

A B.S. in Finance covers the basics of how corporations, individuals, governments and not for profit entities manage cash flow and resources.

Course Examples:

- Real Estate Investments

- Insurance

- Wealth Management

Master of Business Administration – Finance Specialization

This program covers a core of business topics plus a clear picture of financial management.

Course Examples:

- Investments

- Financial Market

- Economic Analysis

Doctor of Business Administration

This program offers experienced professionals the opportunity to gain leadership skills and expertise in international finance.

Course Examples:

- Business Strategy

- International Business

- Law and Compliance

ONLINE FINANCE PROGRAMS

Online finance degree programs cover the study of how to create and manage wealth. They will often look at case studies for a business, individual, gov’ts, and non profits.

In many programs, you’ll take a wide array of courses to learn financial theories and practices. These often help you grasp the value of “time equals money.” When, where and how to invest based on the trends in the global economy.

Such topics may also get into how to manage corporate finance. For instance, you may study ways to divide resources. Or, keep your eyes on the economy and money markets. These skills are key when it comes to how to make solid investments.

It is also likely your program will discuss the finer points of banks and banking. These courses may talk about money, monetary systems and assets. You may even learn how to track financial and economic data.

Another part of finance is all about business. These topics often get into the basics of how to use statistics in strategy. What do the numbers show? How to make a budget and come to smart decisions based on this info?

1

Southern New Hampshire University

- Take advantage of some of the nation’s most affordable tuition rates, while earning a degree from a private, nonprofit, NEASC accredited university

- Qualified students with 2.5 GPA and up may receive up to $20K in grants & scholarships

- Multiple term start dates throughout the year. 24/7 online classroom access.

Popular Programs

Business Administration, Psychology, Information Technology, Human Services…

2

Colorado State University Global

- Ranked #8 by U.S.News & World Report for Best Online Bachelor’s Programs

- Apply up to 90 transfer credits for bachelor’s students, and 9 transfer credits for master’s degree students.

- CSU Global graduates experience a return on investment of 4:1, which means they receive $4 in salary and benefits for every $1 they invest in their education.

Available Programs

Business, Computer Science, Criminal Justice, IT, Psychology…

3

Western Governors University

- Award-winning programs created to help you succeed.

- A quality education doesn’t have to be expensive. Earn an accredited degree for less.

- Programs start monthly – Apply free this week!

Sponsored Schools

WHAT DO FINANCE DEGREE COURSES LOOK LIKE?

Aside from courses, you may gain hands on practice through team work and/or an internship. There may also be some type of final project which helps you put any new knowledge on display. Take a peek inside a finance degree program below.

- Cash Flow

- Corporate Finance

- Insurance

- Financial Markets

- Banking

- Investments

To make earning a degree in finance meaningful, you might choose a focus for your studies. Schools call this a “concentration”. Each focus goes more in depth into one area and basic finance topics. To give you a sense of a few options, we’ve listed some popular choices below.

Some common courses include:

Investment Finance: You may learn about how people and firms can grow their earnings. It is often very data based and analytical. You might study risk, return and assets. You'll likely also study stocks, bonds and funds. Plus, how to watch the markets, spot trends and make informed decisions.

Real Estate Finance: Learn about mortgage markets, credit, risks and lending. Some courses might talk about how to value property and prepare a listing. Others, how to negotiate and close a real estate sale. You also may learn how to handle different processes. This may mean things related to escrow, taxes and the transfer of property.

Wealth Management: You may learn all about working with someone’s goals for their money. You can study how to make smart choices about investing. Some of the key topics often look at risk and securities.

Financial Planning: This may help you prepare to pursue the Certified Financial Planner CFP® certification. This means, you may study things like how to develop financial plans. Courses also discuss modern concepts, principles and frame works for long range financial decision making. You'll likely study ethics and regulations along the way.

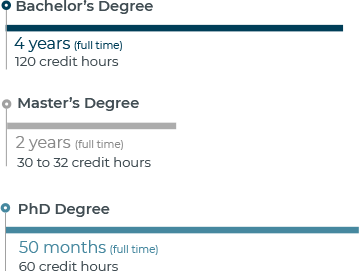

HOW LONG DOES IT TAKE TO EARN A FINANCE DEGREE?

It may take about four years of full time study to earn a bachelors degree in finance online. If you plan to earn a Masters or MBA in Finance, this could take another 2 years full time. PhD and DBA degree programs may take about 3 years post master’s.

You’ll want to factor in whether you plan to take on a full course load. Transfer credits may speed up the time it takes fr you to complete, whereas extra research may slow things down.

FINANCE DEGREE PROGRAM EXAMPLES

| School | # of Credits Required | Start Dates | Minimum Months to Complete |

| Purdue Global University | 60 | Multiple | Less than 2 years |

| Regent University | 42 | Multiple | 16 |

| Grand Canyon University | 54 | Multiple | 22-24 |

HOW MUCH DOES IT COST TO GET A FINANCE DEGREE?

Recent data on average tuition costs for finance degrees show a range of between $7,038 (in state public) and $31,158 (out of state private). Cost for online finance degree programs do vary for many other reasons. For instance, some students may enter a program with transfer credits, federal assistance or scholarships.

| School | # of Credits Required | Cost Per Credit | Total Tuition Cost |

| Ashford University | 120 | $485 | $60,950 |

| Grand Canyon University | 54 | $575 | $31,050 |

| Walden University | 49 | $990 | $48,510 |

TOP SCHOOLS FOR EARNING A FINANCE DEGREE

Last check, 48,896 degrees in finance were awarded to students. Most of these programs were at the bachelor’s level. Of the remainder 6,848 were granted at the master’s level and 52 at the doctoral level.

| School | 2021 Degrees awarded | 2023/24 Tuition (out of state unless *) |

| CUNY Bernard M Baruch College | 1006 | $15,414 |

| University of Pennsylvania | 658 | $66,104 |

| Florida International University | 769 | $18,963 |

| Florida State University | 597 | $18,786 |

| University of Georgia | 519 | $30,220 |

| Ohio State University-Main Campus | 767 | $38,365 |

Estimated for full time, beginning undergrad students

CHOOSING A FINANCE DEGREE ONLINE ACCREDITED PROGRAM

There are many rules in the financial field. People at work in this field often have to make ethical decisions. Some will also go the extra mile and earn certain certifications. For these reasons, is important to choose an accredited business school.

Schools may seek one or two kinds of accreditation. The first is for the school itself (institutional). The second, once they have the first kind is for certain programs (e.g. online finance degrees). Each type of approval is voluntary. It’s a status that shows the public that their programs and faculty meet industry and quality standards. Note that only regionally/nationally accredited schools can apply for the specialized approval.

These accrediting agencies apply to the U.S. Department of Education (DOE) for federal recognition. In turn, each school applies to a certain agency to undergo their scrutiny. This often involves at least one site review by an outside team of professionals. These reviewers want to see that the program follows “best practices” in business. Also, that the people teaching courses are ethical and knowledgeable.

Because accreditation lasts for a set period (e.g. 7 years for the IACBE), it is an impetus for a school to keep standards up. That the course material has up to date info about the financial industry, things of this nature.

Usually, these agencies keep data bases so you can check the status of the program or school. It’s often more accurate than a school’s website. Three agencies you’ll likely come across for business programs – finance is one subset – are:

FINANCIAL ANALYST CAREER PATHS AND POTENTIAL SALARIES

There are many roles closely related to financial analysis. The skills you learn from an online program may prepare you for work in fields with similar economic, math, statistical and financial subject matter. Research which options may be available using stats compiled by the BLS.