WHAT IS AN ECONOMICS DEGREE?

An online degree in economics studies trends and theory. So as an online student, you may study labor, wealth and the markets. Plus, the things like goods and services we pay for. Some economics students use their degree to go for a career as an Economist. These pros need to know how banks operate and why cost inflation occurs. This may in turn help to impact public policy.

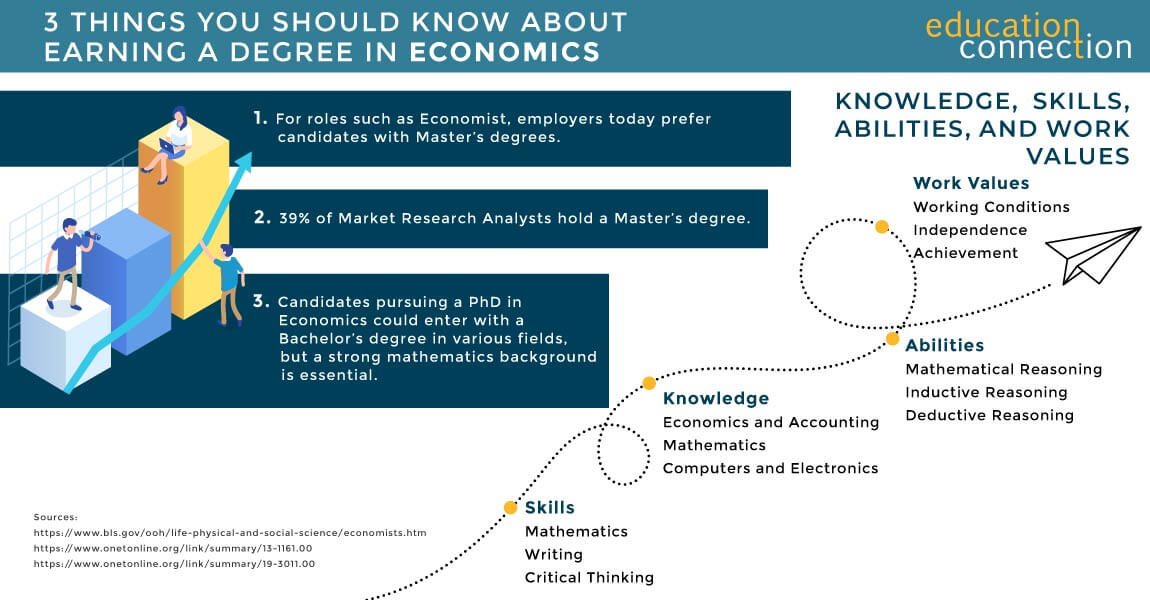

They also use this info to solve problems using math. Some of these problems relate to unemployment. Others to stagnant wages and income inequality. When looking into online learning, there may be degrees at all levels. Bachelor’s, master’s and PhDs. All these programs may cover the above kinds of coursework. Just, in a different way.

TYPES OF ONLINE DIGITAL MARKETING DEGREE PROGRAMS

Bachelor of Science in Business Economics

This program features a business core. Plus a side focus on economics. You’ll study areas like cost and inflation theories. Also, market structure, and capital budgeting. These areas may help you learn to think critically. And solve issues in business, finance, and beyond.

Course Examples:

- Business Statistics

- Political Economics

- Macroeconomics

MA in Behavioral Economics

This program helps students understand economics from a psychological perspective. You’ll examine subjects like decision-making, negotiation, and how consumers make choices. And, you’ll apply theories to solve socioeconomic problems.

Course Examples:

- Choice Architecture

- Brain and Behavior

- Consumer Motivation

MBA in Business Economics

The MBA covers core business knowledge, from managerial problem solving to global commerce. The Business Economics specialization adds three additional courses that apply economics to the business world.

Course Examples:

- Macroeconomics of Financial Markets

- Managerial Economic Analysis

- Market Structure & Firm Strategy

ECONOMIC DEGREE ONLINE PROGRAMS

One may find economics online at two main degree levels. Undergraduate or graduate. What most programs have in common is a focus on math. Like calculus and statistics. When looking into school search results, some schools offer niche economics majors. These may be a useful path for graduate study where you might have a sense of career plans. Each area adds core courses that may refine skills and knowhow. A few are:

- International Economics

- Environmental Economics

- Economic Development

Bachelor’s in Economics Programs

If going for an online bachelor’s degree there may be two options. A bachelor of arts (BA) or bachelor of science (BA). Of the two, a BA may focus on social science and liberal arts. While a BS tends to be more technical. Both programs may entail 120 credit hours including a final capstone.

Common programs include:

- Bachelor of Arts (B.A.) in Economics – This program takes a liberal arts approach. You may focus more on economic theory than applied economics. And, you may take more electives or language courses.

- Bachelor of Science (B.S.) in Economics – This program tends to emphasize applied economics. That means you’ll apply economic theory to practical problems – often using business case studies or simulations. You may also focus more on math and quantitative analysis.

Bachelor’s programs include courses like:

- Introductory Econometrics

- Money and Banking

- Applied Economic Statistics

- Global Economic Policies

- Economic History and Modern Development

- Current Issues in American Economic Policy

- Basics of Business

Some programs also offer concentrations. For instance, you could focus on managerial economics, finance, or marketing.

Master’s in Economics Programs

A master’s in economics is a graduate degree. There may be master of arts (MA), master of science (MS) and MBAs with an economics focus. These programs build on prior knowledge and go deeper. As a result, you may learn how to research and use analytical methods.

Common programs include:

- Master of Science (M.S.) in Economics – This program may cover both theory and applied economics. As a STEM program, it may emphasize quantitative courses.

- Master of Arts (M.A.) in Economics – The M.A. is also a STEM program, with a focus on quantitative and analytical skill areas. But, it may offer more flexibility to take electives that promote critical thinking, research, and problem-solving.

- Master of Business Administration (MBA) in Economics – The MBA is a business degree. So, the program involves a broad overview of business topics, along with concentration courses in economics.

Master’s programs include courses like:

- Behavioral Economics

- Survey of Economic Development

- Labor Economics

- Economic Analysis of Multinational Corporations

- Game Theory

- Open Economy Macroeconomics

Master’s in Economics programs often include concentrations that could help you narrow your focus. For instance, a concentration in financial economics covers portfolio management and other skill areas. A concentration in advanced theory may be great for those considering a PhD program down the road.

Economics Doctoral Programs

A PhD is a research degree and the highest award in economics. It tends to go broad and deep. You may study the theories and history of economic thought through time. Plus, study other areas that impact the field. Such as political science and more financial analyst themes. Then go deeper into your own research to complete a dissertation.

- Theoretical and Applied Econometrics

- Health Economics

- Game Theory

- Behavioral Economics

- Public Finance

- Energy Economics

Earning a PhD in economics usually means writing one or more major research papers. In the final years of the program, students also write and defend a dissertation.

1

Southern New Hampshire University

- Take advantage of some of the nation’s most affordable tuition rates, while earning a degree from a private, nonprofit, NEASC accredited university

- Qualified students with 2.5 GPA and up may receive up to $20K in grants & scholarships

- Multiple term start dates throughout the year. 24/7 online classroom access.

Popular Programs

Business Administration, Psychology, Information Technology, Human Services…

2

University of Arizona Global Campus

- 99% of University of Arizona Global Campus students study online

- University of Arizona Global Campus offers affordable tuition, so college is accessible to many students.

- he University of Arizona Global Campus (formerly Ashford University) is accredited by WASC Senior College and University Commission (WSCUC)

Available Programs

Accounting and Finance, Information Technology, Political Science…

3

Western Governors University

- Award-winning programs created to help you succeed.

- A quality education doesn’t have to be expensive. Earn an accredited degree for less.

- Programs start monthly – Apply free this week!

Sponsored Schools

WHAT DO ECONOMICS DEGREE COURSES LOOK LIKE?

Some common courses include:

Comparative Economic Systems: How do economies around the world compare? This course may explore resources and income. Also fiscal growth in many places.

Econometrics: In this course, you may learn how to use statistics to forecast. You may study tools, theories, and how to model data.

Public Finance and Fiscal Policy: This course explores how financial policy impacts the public. You may look at areas like tax, social welfare, and public goods.

Financial Crisis: What can we learn from events like the Great Depression? This course covers the hows and whys of a crisis. And how to keep it from happening again.

Game Theory: Curious about how games play a role? This course may cover how to make models that predict based on game play.

Behavioral Economics: In this course, you may learn about the brain and behavior. In other words, find out the feelings behind the choices we make about money.

Statistical Analysis: Study how statistics applies to this field. You may learn methods, tools, and theories that help solve problems.

Microeconomics: This course looks at the impact of smaller factors. You may study areas like buyer choices and workers’ wages.

Macroeconomics: Big picture factors are the focus of this course. You could explore ideas like national income, output, and fiscal policy. Or labor economics and how it impacts other areas.

HOW LONG DOES IT TAKE TO COMPLETE AN ECONOMICS DEGREE PROGRAM?

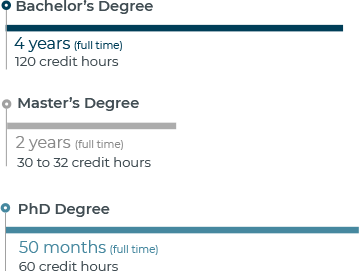

Full time students may earn a Bachelor’s degree in about four years. A Master’s may take about two more years. And a PhD often calls for at least four more.

ECONOMICS DEGREE PROGRAM EXAMPLES

| School | # of Credits Required | Start Dates | Minimum Months to Complete |

| Ashford University | 42 | Multiple | 22 |

| The Chicago School of Professional Psychology | N/A | N/A | 24 |

| Regent University | 42 | N/A | 16 |

THE AVERAGE COST OF AN ECONOMICS DEGREE PROGRAM

DataUSA put the average cost of attending a public, four year school at $8,678 per year. Private and for-profit schools had higher average tuition: $47,564 per year. Of course, you could find schools that cost more or less than these averages. Compare tuition costs for these online programs:

| School | # of Credits Required | Cost Per Credit | Total Tuition Cost |

| Regent University | 42 | $650 | $27,300 |

| Ashford University | 120 | $485 | $58,200 |

| The Chicago School of Professional Psychology | N/A | $1,164 | N/A |

TOP SCHOOLS FOR ONLINE ECONOMICS DEGREE PROGRAMS

According to DataUSA, 881 institutions offered general economics programs. From those schools, 49,466 degrees were awarded to students.

| School | 2023 Degrees awarded | 2023/24 Tuition (out of state unless *) |

| University of California Los Angeles | 1,052 | $44,524 |

| University of California Berkeley | 830 | $45,627 |

| University of California San Diego | 455 | $46,042 |

| University of Wisconsin Madison | 714 | $40,603 |

| University of California Santa Barbara | 679 | $45,742 |

| University of California Davis | 614 | $46,024 |

| The University of Texas at Austin | 408 | $42,778 |

| University of Illinois at Urbana Champaign | 495 | $34,501 |

| New York University | 602 | $60,438* |

| University of Michigan Ann Arbor | 690 | $58,072 |

Estimated for full time, beginning undergrad students

CHOOSING AN ACCREDITED ECONOMICS DEGREE PROGRAM

Accreditation is one way to check quality standards. There are two kinds – school and program. Accredited schools tend to take part in state and federal federal financial aid. (Financial aid may be available for those who qualify.)

Economics degree programs often fall under “business”. So, the same agencies may accredit both kinds of programs. These include:

- Accreditation Council for Business Schools and Programs ( ACBSP ): Accredits programs in business. Or related areas. Like business economics. They focus on teaching quality and student outcomes. Also, if a school commits to improve.

- International Accreditation Council for Business Education ( IACBE): Accredits all levels of business programs. IACBE looks for excellence in business education. Plus, faculty qualifications and more.

- AACSB. Accredits business schools. They evaluate areas like innovation. Also faculty, and professional engagement.

WHAT KIND OF JOBS CAN YOU GET WITH AN ECONOMICS DEGREE?

Business and financial careers may grow 10% from 2023 to 2033. That’s faster than average for all occupations! Here are a few career paths to consider if you plan to earn an economics degree.