What is a Forensic Accountant Degree Online Program?

If you pursue a forensic accountant degree online program, you will cover the investigation of financial crimes. You could learn how you can get to the bottom of crimes. Some crimes you could focus on could include embezzlement, securities fraud, and more. This will mean you will be learning both accounting concepts and investigative techniques.

If you like complex fields, you could find that forensic accounting is fitting for you. If you study in this field, you will cover finance, business, and law. You may even study technology and cyber security. And, you may do some numbers based detective work. Also, you could find yourself inspecting financial data for errors.

Are your interests diverse ? Do you have strong math and analytical skills? Then this field may be right for you!

TYPES OF FORENSIC ACCOUTNING DEGREE PROGRAMS

A.S. in Forensic Accounting

In this type of program you will learn the basics of detecting and analyzing fraud. What will you study? You can expect to study business and accounting concepts. You will also cover strategies for how you can find and prevent financial crimes.

Course Examples:

- Fraud Examination

- Legal Elements of Fraud

- Financial Accounting

- Wealth Management

B.S. in Accounting (Auditing / Forensic Accountancy)

At the B.S. level, you will build your foundations in accounting, You may specialize in forensic accountancy. Your courses could span from business to finance. You could also study other key areas. However, you will keep your focus on forensics.

Course Examples:

- Advanced Forensic Accounting

- Auditing

- Federal Tax

M.S. in Forensic Accounting

With an M.S. you may build on your prior studies and your experience in accounting. The courses you take in forensic accounting will help you gain new skills and strategies. Are you planning a career pivot? Then, this path could be ideal for you.

Course Examples:

- Digital Forensics

- Statistical Methods for Forensic Accounting & Assurance

Forensic Accounting Online Degree Programs

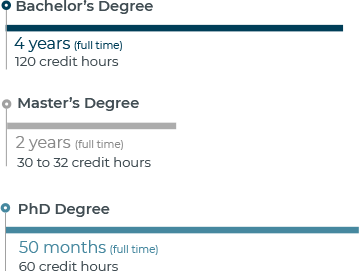

You may have heard of standard accounting degree programs. You probably have seen these programs occur at different levels. Similarly, if you choose to study in a forensic accounting online degree program, you will find they are also available at different levels. The longer you study, the more complex your curriculum may be. You will find that all programs share a common goal. That goal is to teach you how to the bottom of financial crime.

Undergraduate Forensic Accounting Programs

At some colleges, you may pursue an Associate’s degree in Forensic Accounting programs. That said, in order for you to pursue a forensic accounting career path, you will need to earn at least a B.S. in Forensic Accounting. Or, you could earn a B.S. in a related field.

In your B.S. program in forensic accounting and fraud investigation, you would take courses in a few core areas. You could cover topics such as finance, accounting, business, and law. You will find that these subjects often overlap. For instance, you could take courses in business law or financial accounting.

If you take business courses such as managerial accounting, you will gain understanding as to how companies keep financial records. This could prepare you to recognize errors in businesses’ financial data.

Are you interested yet? If you go this route, you will find that the heart of the program includes forensic accounting courses. In these courses, you will cover topics like investigation, detection, and documentation of financial crimes. You could learn, for example, how to analyze financial records. Then you would cover how to document your findings. You could even study forensic psychology. As such, you may cover interview techniques.

Finally, you will take general education courses. You can also take electives that help fill in your background knowledge. So, you could study topics like microeconomics, communications, and other useful areas.

Look for bachelor’s programs like:

- Bachelor of Science (B.S.) in Accounting (Forensic Accounting & Fraud Examination)

- Forensic Accounting BS

- Bachelor of Business Administration (BBA) in Forensic Accounting

Master’s in Forensic Accounting Programs Online

Master’s programs in forensic accounting will build on your undergraduate degree in accounting. Do you already have an accounting background? Perhaps, then, you want to explore a new direction in your field. This may be a good way for you to go. Also, some employers prefer to hire an accountant with an M.S.

What will you study in your M.S. program? At the graduate level, you can expect to take a more in depth look at accounting. And, you will study investigative techniques. You could work on everything from internal auditing to cyber forensics. Also, you could learn case studies and role playing. This will help you prepare to solve white collar crimes.

You may explore more applications for forensic accounting across different fields. You could apply forensic accounting to business, finance, healthcare, and even counter terrorism.

1

Southern New Hampshire University

- Take advantage of some of the nation’s most affordable tuition rates, while earning a degree from a private, nonprofit, NEASC accredited university

- Qualified students with 2.5 GPA and up may receive up to $20K in grants & scholarships

- Multiple term start dates throughout the year. 24/7 online classroom access.

Popular Programs

Business Administration, Psychology, Information Technology, Human Services…

2

University of Arizona Global Campus

- 99% of University of Arizona Global Campus students study online

- University of Arizona Global Campus offers affordable tuition, so college is accessible to many students.

- he University of Arizona Global Campus (formerly Ashford University) is accredited by WASC Senior College and University Commission (WSCUC)

Available Programs

Accounting and Finance, Information Technology, Political Science…

3

Western Governors University

- Award-winning programs created to help you succeed.

- A quality education doesn’t have to be expensive. Earn an accredited degree for less.

- Programs start monthly – Apply free this week!

Sponsored Schools

What Is the Curriculum of a Forensic Accounting Degree Program?

So, what can you expect from your curriculum? If you pursue a forensic accountant program, your curriculum will cover theories and techniques. You could use these for financial investigation. You will also study the context of financial crimes. So, the topics you cover could range from law and ethics to the psychology of deception.

Below are some common courses you could find in your forensic accounting degree program:

Auditing and Forensic Accounting: In this fundamental course, you will take a close look at fraud. You’ll learn how to recognize, handle, and even prevent fraud in organizations. That means studying skills for detecting and investigating crime like stock fraud and embezzlement.

Interviewing Techniques for Fraud Investigation: Learn how questioning fraud suspects is important to solving white collar crimes. This course covers interrogation techniques, documenting your interviews, and interpreting cues.

Intermediate Accounting: This program could feature courses in essential accounting concepts. These include financial statements, taxation, employee benefits, and more. Understanding correct accounting practices is key to recognizing when something isn’t right!

Cyber Forensics: Study how technology and the web have changed the way financial crimes are committed and solved. So, a course in cyber forensics covers how to investigate computer based crimes. That includes collecting digital evidence, retrieving data, and much more.

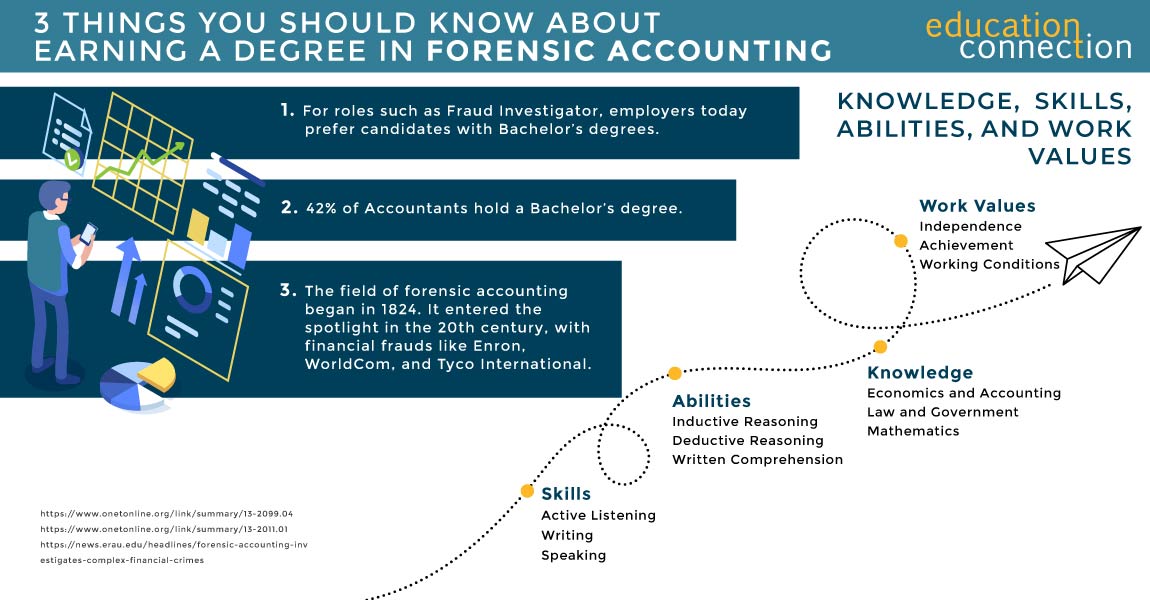

How Long Does It Take to Earn a Degree in Forensic Accounting?

The length it will take you to complete a forensic accounting degree online program varies. This will depend on your school and your schedule. On average, earning a B.S. in Accounting will take you four or five years. Earning an M.S. could take one to two years. That is, following earning your B.S.

Forensic Accounting Degree Examples

| School | Degree Level | # of Credits | Min Months to Complete |

| Purdue University Global | B.S. | 180 | 24 |

| Southern New Hampshire University | M.S. | 36 | 24 |

| Penn State World Campus | M.S. | 30 | 24 |

The Cost of a Forensic Accounting Degree program

You can see, according to the DataUSA, the media cost of attending an in state public, four year school is $7,070 per year. If you choose to attend a private or for profit school, you could pay up to $32,218 per year, on average. You can compare tuition for these schools with financial forensic programs below:

| School | Degree Level | # of Credits | Cost Per Credit | Total Tuition Cost |

| Purdue University Global | B.S. | 180 | $371 | $66,780 |

| Stevenson University | M.S. | 36 | $695 | $25,020 |

| Southern New Hampshire University | M.S. | 36 | $627 | $24,453 |

Top Schools That Offer Forensic Accounting Degree Programs

You can see that the DataUSA lists 24 institutions that have financial forensic programs. That includes forensic accounting. From those schools, you will find that 364 degrees were awarded to students in 2022. That is the most recent data. Most of these degrees, you can see, were at the B.S. level.

| School | 2022 Degrees awarded | 2023/24 Tuition (out of state unless *) |

| Utica College | 98 | $22,110* |

| CUNY John Jay College of Criminal Justice | 131 | $15,420 |

| Carlow University | 15 | $34,502 |

| Pfeiffer University | 9 | $33,930 |

| The College of Saint Rose | 3 | $37,452* |

| West Virginia University | 21 | $27,360 |

| Champlain College | 8 | $45,550* |

| University of Northwestern Ohio | 7 | $12,930* |

| Missouri State University-Springfield | 7 | $17,928 |

| Christian Brothers University | 5 | $37,300* |

Pursuing Forensic Accountant Certification

Do you want to be a certified forensic accountant? You must first become a Certified Public Accountant (CPA).

Let’s give you an overview. First of all, what is a forensic accountant? If you are a forensic accountant, you are a type of pubic accountant. You can, like many public accountants, become a CPA. If you choose that, you would be required to pass the four part Uniform CPA Examination. This comes from the American Institute of Certified Public Accountants (AICPA). In most cases, you must also complete 150 semester hours of college course work.

So, how do you become certified?

AICPA awards the Certified in Financial Forensics (CFF) Credential to eligible CPAs. What requirements do you need? Take a look below:

- Hold a valid, state issued CPA license or certificate.

- Pass the CFF examination. This tests your professional knowledge.

- Complete the CFF Credential Application online. This means you attest to meeting the minimum Business Experience and Continuing Professional Development (CPD) requirements.

- Pay a credential fee.

In summary, to become certified in forensic accounting, you must first become a CPA. Then, you must earn your CFF credential.