What is an Online MBA Program?

If you are interested in advanced business management, then pursuing an MBA could be right for you. Online MBA (Master of Business Administration) programs offer you the opportunity to earn an advanced business degree. What can you expect from your online MBA program? In these programs, you cover the discipline of running an organization.

In an MBA program, you will often take courses across all corners of business. You could study everything from finance and accounting to marketing and strategy. And, many programs will let you choose a concentration in an area that interests you.

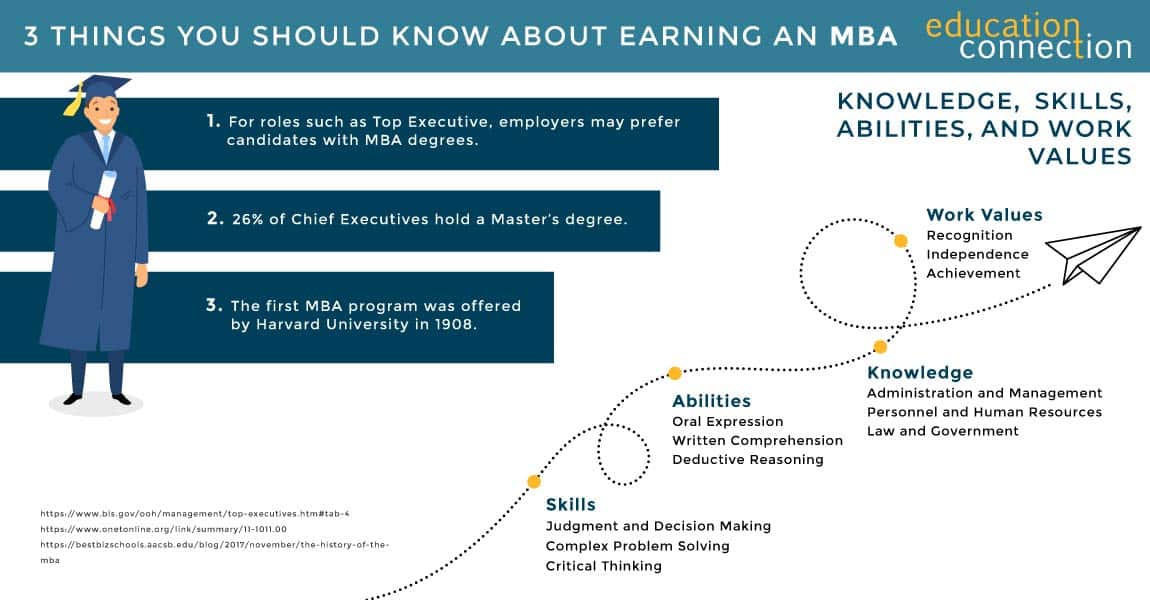

So, do you think you want a career in business? If you are interested in becoming a one of the nation’s top executives, then you are wise to earn your MBA degree. This is especially true if you work for a large corporation. So, if you want to help businesses reach their goals, pursuing an online MBA could be a good start for you.

Types of Online MBA Programs

How do you know if you a good candidate for an online MBA program? You don’t have to know all of your goals upfront. For one thing, you could design your MBA program to help you pursue your diverse set of goals. You could earn an MBA to focus on general business, for example. Or, you could delve into another concentration you prefer, such as human resources. Or, you could focus on finance.

MBA in Health Care Administration | MBA in Operations Management | General MBA |

| In this program, you will apply the business concepts you have learned to the healthcare field. As a student, you will learn to manage health systems and resources. Also, you will learn what it takes to run hospital departments, long term care facilities, or clinics. | Concentrate your course work in Operations Management. You may study concepts such as quality management and logistics. You could also explore operations from a global perspective. | In this flexible program, you should gain a strong foundation in advanced business. Study everything from marketing to economics through a managerial lens. |

Course Examples:

| Course Examples:

| Course Examples:

|

Additional MBA concentrations you could consider include:

- Accounting

- International Business

- Health Care Management

- Supply Chain Management

- Project Management

- Sustainability

- Computer Information Systems

- Marketing

- Entrepreneurship

Executive MBA Programs (EMBAs)

Are you interested in pursuing more than a traditional MBA program? A traditional program may be right for you if you have a diverse background and goals. However, if you want to go a step further, you should consider an EMBA program. EMBAs are right for you if you are already working in business.

What makes you a good candidate for an EMBA? Ask yourself a few questions about your goals. If you are hoping to pursue an advanced managerial role in the future, you may wish to earn an EMBA now. Also, if you are a working student now, an EMBA program may perfect for you. One thing you should note is that this route may offer you an accelerated track.

While you will often cover a broad overview of business in a traditional MBA, your work in an EMBA program would be different. There, you may focus more on applying business theories to your current workplace or interest area.

1

Southern New Hampshire University

- Take advantage of some of the nation’s most affordable tuition rates, while earning a degree from a private, nonprofit, NEASC accredited university

- Qualified students with 2.5 GPA and up may receive up to $20K in grants & scholarships

- Multiple term start dates throughout the year. 24/7 online classroom access.

Popular Programs

Business Administration, Psychology, Information Technology, Human Services…

2

University of Arizona Global Campus

- 99% of University of Arizona Global Campus students study online

- University of Arizona Global Campus offers affordable tuition, so college is accessible to many students.

- he University of Arizona Global Campus (formerly Ashford University) is accredited by WASC Senior College and University Commission (WSCUC)

Available Programs

Accounting and Finance, Information Technology, Political Science…

3

Western Governors University

- Award-winning programs created to help you succeed.

- A quality education doesn’t have to be expensive. Earn an accredited degree for less.

- Programs start monthly – Apply free this week!

Sponsored Schools

Online MBA Course Examples

You will find that what most programs have in common is a business core education. What does this mean for you as a student? It means that your core courses will provide you with a foundation in the major aspects of businesses. As such, you will learn how companies run. You may also learn how they become profitable. That means you will be exploring everything from how to market a product, to how you could serve in a leadership role.

Fundamentals of Business: This course offers you an overview of the business world. Expect to explore contemporary issues and case studies. And, you could practice skills like business analytics and strategy.

Corporate Finance: Finance is a key pillar of business. A corporate finance course will teach you the fundamental theories. You’ll explore concepts like shareholder value and how financial markets work. And, you’ll learn finance vocabulary and techniques.

Entrepreneurship: Are you interested in potentially launching your own business venture? Even if the answer is no, you may still take this course. It usually dives into topics ranging from economics to management strategies.

Corporate Communication: Learn how you can get your message across is essential for leadership. A business communications course covers speaking, listening, and writing. You could also learn communication strategies for different audiences.

Marketing: In this course, you will explore the theory and practice of marketing. You’ll study everything from consumer behavior to product development. And, you could learn about both domestic and global markets.

Accounting: In this course, you will gain an understanding of financial accounting fundamentals for prospective consumers of corporate financial information

How Long Does It Take You to Earn an MBA Degree?

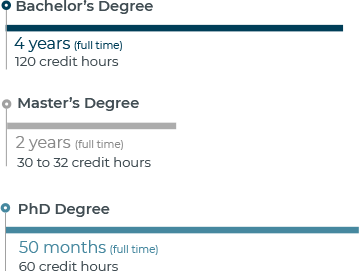

Are you wondering if you can afford the time it takes for you to earn a degree? You can easily research your options. Online MBA programs generally take you about two years to earn. In some accelerated programs, you will find that you may earn your degree in one year or less.

The length of your program usually depends on whether you study part time or full time. As an MBA student, you would be in the majority if you work full time while also pursuing a degree. There will be many others in your boat.

1 Year MBA Programs

| School | # of Credits Required | Min Months to Complete |

| University of Miami | 35 | 7 Months, full time |

| American Intercontinental University | 48 | 12 Months, full time |

| Emporia State University | 36 | 12 months |

| Pepperdine | 46 | 12 Months, if you have a business undergrad degree |

| Capella | 45 | 12 Months |

How Much Does an MBA Program Cost You?

Per DataUSA, the median in state tuition you could expect to pay at public universities was $6,974 per year. You should keep in mind that’s according to the most recent data, from 2022. You can guess that if you attend private or for profit schools, you will pay more, at $31,220 per year. Compare tuition for these MBA programs below:

| School | # of Credits Required | Cost Per Credit | Total Tuition Cost |

| Colorado Christian University | 39 | $583 | $22,737 |

| American Intercontinental University | 48 | $611 | $29,328 |

| Emporia State University | 36 | $350 | $12,600 |

Top Schools that offer MBA Degrees

Are you wondering what the top schools are? Or where you should start when it comes to choosing your MBA program? You will find that DataUSA lists 2,873 institutions with Business Administration, Management, and Operations programs (including MBA programs). You can see those schools awarded 403,753 degrees to students in 2022 (the most recent data). Most of these degrees, you will find, were at the MBA level.

| School | 2022 Degrees awarded | 2023/24 Graduate Tuition |

| University of Phoenix Arizona | 12,225 | $9,552* |

| Western Governors University | 7,891 | $8,300* |

| Ashford University | 3,265 | $13,160* |

| University of Maryland University Global Campus | 3,738 | $7,992 |

| Southern New Hampshire University | 7,164 | $16,450* |

| Columbia Southern University | 2,450 | $5,808* |

| Liberty University | 3,446 | $21,222 |

| DeVry University Illinois | 2,690 | $17,488* |

| Colorado Technical University Colorado Springs | 4,006 | $12,760* |

| Broward College | 2,980 | $8,952 |

How Do You Choose Your Accredited MBA Program?

Accreditation, you will learn, is a stamp of quality for your MBA program. So, how do you choose an accredited MBA program that is right for you? It is an important step for you to keep in mind. What does it mean for you to pursue an accredited MBA program? It means that your program must uphold standards set forth by an organization.

You will find three main organizations that accredit your MBA program or business school. These include:

- Association to Advance Collegiate Schools of Business (AACSB). AACSB accredits your business school. They evaluate your school based on standards that follow three themes: engagement, innovation, and impact. And, they look at everything at your school, from academics to your school’s faculty and staff.

- The Accreditation Council for Business Schools and Programs (ACBSP). ACBSP accredits B.S., M.S., and Ph.D. programs. That would include your MBA program. You will see their model of excellence features a set of standards which your program must follow. This is in order for your program to earn accreditation.

- International Accreditation Council for Business Education (IACBE). IACBE accredits your business education at all levels, including your MBA program. They evaluate everything from your school’s faculty quality to your outcome as a student.

If you pursue an online MBA program, you can access accreditation. That said, not all programs you will come across will hold a specific business accreditation. It is important that you always make sure that your college or university is accredited by an organization recognized by the U.S. Department of Education.